The council finalised its budget last Monday 24 February 2025 at a special meeting of the Full Council and so I thought I would talk a bit about the Council finances.

The council spends money on services to the public that are funded by:

- Council tax. The money collected from residents is 100% kept by the council and split between the City, County, Police and Fire Authorities and the Combined Authority. The amount retained by the City Council next year out of the total paid by a Band D property is £232.

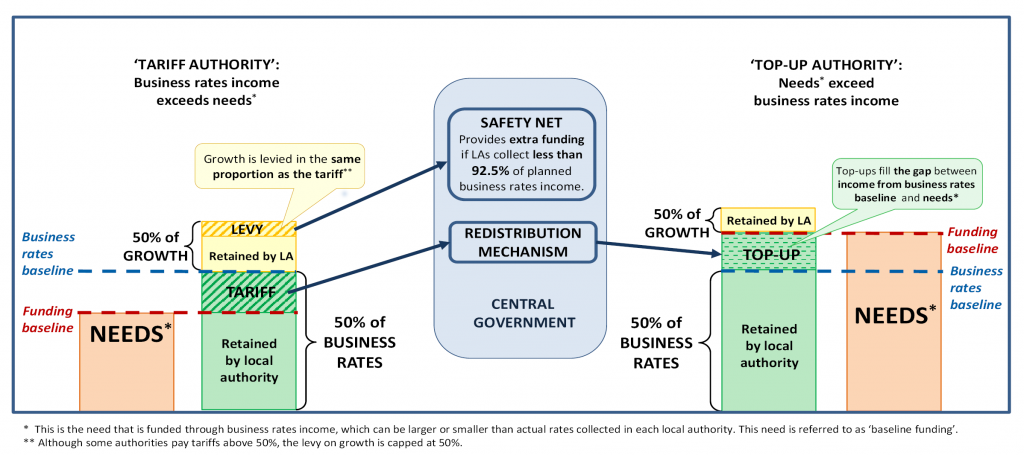

- Business rates. Only a proportion of business rates collected is retained by the council. A large part is paid over to central government for redistribution to councils with less ability to raise money while having high needs

- Fees and charges for swimming pools, parking, planning applications etc.

- Government grants. This is currently calculated and paid on an annual basis which makes it difficult for councils to plan ahead.

The overall budget for this year ending 31 March 2025 is:

Gross costs £67.5m

Fees and charges £38.9m

Net cost to be funded from central government £28.6m

Every year, the council rolls forward it’s income and expenses using the most appropriate estimate of what the likely increase over the next 5 years will be.

- Income: some fees are fixed by central government, for other types of income the local council has some discretion over how much to charge. Rental income is usually contractually set.

- Expenses: for services purchased it is usually forecast inflation and for staff costs it is the % salary increase which is negotiated annually with the national union for local government workers, UNISON.

The budget gap is the difference between the future income and the expenses. The expenses are usually higher than the income and therefore, savings need to be found.

Cambridge City Council has identified a budget gap of £11.5 million that needs to be closed within the next 5 years. This is estimated and could be much larger or smaller. It is driven by:

- Inflation

- Amount of government grants and real term cuts in government spending

- Amount of interest income which has recently been high but which goes down when interest rates decrease and when the money is spent

Compared to the budget gross costs of £67.5m this deficit is significant.

There is a big change to the amount of funding from central government planned under the coming reform. The Labour Government have said they intend to:

- Do a reset of business rate retentions

- Reform the calculation which decides how much money local councils get.

Business rate reset

Currently, any increase in the amount of the business rates collected over a baseline set in 2013 is retained by the Council. This is about £5m a year which from next year (if the reforms go through) will be added to the amount sent to central government for redistribution.

Redistribution of business rates

There has been another consultation on how to calculate the funding that councils get to retain (if a net contributor) or receive (if a net receiver). The government attempts to assess the relative needs of each council using the following key factors:

- Population changes. Cambridge is growing very fast and we are disadvantaged by using over 10 year old population estimates

- Deprivation and local care needs. Although Cambridge is one of the wealthier cities in the UK, there are areas of deprivation also.

- Cost adjustments to reflect the different cost of a service in different parts of the country

- How much income can be raised locally.

It is difficult to see at the moment exactly how this will affect funding to Cambridge but the council estimates that the business rate reset will outweigh the effect of the redistribution calculation and so there will be a net reduction in funding.

For those who like diagrams this is how the business rates system works:

The Council has decided, given the uncertainty, that they will look for £6m in savings for the next two years and then review the position again to avoid cutting costs too much in the event that some of the anticipated reductions in funding do not occur.

The savings that they have found amount to £5.7m but this is offset by increased costs of £1.8m making the net ongoing savings £3.9m. The most notable of these consist of:

- A major reorganisation of the council staff to bring about efficiencies £1.3m.

- A closure of public toilets £0.1m

The LibDems tried to challenge some of these reorganisations, in particular those that affected the public realm teams i.e.

- people who deal with fly-tipping and abandoned items including vehicles; with graffiti and illegal advertising. They look after lost and stray dogs. They deal with illegal camping, with littering and verge parking

- empty the bins on the streets and parks in the city, and maintain our green spaces.

We were outvoted although it is difficult to see how the services to the public will not be affect given the sizes of the reductions in the number of people looking after this.

There remain savings to be found to reach the £11.5m deficit. There are a few smaller reorganisations to be carried out. One larger project that is coming is the Civic Quarter refurbishment. This is both very environmentally sound as it insulates the Guildhall properly but also financially sensible because it enables the Council to move all Council staff into the building and frees up Mandela House to be sold or rented. The current saving is estimated at £1m a year. Lots more to come on future savings.

Leave a Reply

You must be logged in to post a comment.